#30 - TheRealReal

Luxury consigned marketplace.

The RealReal - (NASDAQ: REAL)

The RealReal is a pre-owned luxury marketplace focused on working with sellers via a consignment model to sell luxury goods to buyers. The RealReal operates both an online marketplace as well as a number of retail stores.

If you want to become a paid subscriber sign up below!

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Industry Overview

The RealReal competes with other companies that buy and sell luxury goods. Competitors could be other luxury companies like Cartier, Chanel, other marketplaces like eBay, Farfetch, and Amazon, or other sources of luxury goods such as Craigslist, garage sales, or wherever else buyers find luxury products.

One of the major differentiators between The RealReal and other competitors is the focus on being a marketplace for consigned luxury inventory instead of being just a luxury marketplace (my understanding of Farfetch). Farfetch and The RealReal might encroach on each other’s turf in a few years which wouldn’t surprise me.

Business Overview

The RealReal is an online marketplace for consigned luxury goods. The RealReal works with vendors and consigners to sell goods to buyers. The RealReal takes a cut of the transaction and recognizes it as revenue.

The RealReal buys used luxury clothing from consumers and sells it online through its marketplace or sells it through its retail stores. The RealReal acquires luxury goods through consigners at their homes, through virtual appointments, and direct shipping. The RealReal also uses its stores and vendors as another way to buy supply of luxury goods. Consigners achieved a commission rate of ~64% in 2020 and can earn up to 85% in commissions.

The RealReal has a couple of other revenue generating segments such as direct revenue which is when it takes ownership of inventory without paying commission fees to consigners. It also recognizes revenue from shipping fees and “First Look” which is a program where buyers get early access to items.

The RealReal operates retail stores which improve unit economics by acquiring higher value buyers and consigners, increasing lifetime value, increasing AOV, and lowering return rates. The RealReal has a number of these stores with locations in Los Angeles, San Francisco, SoHo and Upper East Side in NYC, and in Chicago.

Total Addressable Market

The global luxury market is of course another massive market. One source has estimated the global luxury market to be worth ~$400 billion by 2027. The US and China are estimated to be the largest markets for luxury products.

Another source has estimated the second hand luxury market to be worth $25 billion. The RealReal processed ~$1 billion in GMV in 2020. Before the pandemic, The RealReal had strong revenue growth rates (seen below) and I wonder if these growth rates will pick up again post-COVID.

Competitive Advantages

Network effects

Just like other marketplace business models, if The RealReal can connect supply and demand in a fragmented market with high transaction costs, then this will be a hard business to replicate. As more buyers and sellers come onto the platform, then The RealReal’s competitive position will strengthen.

There are other large luxury marketplaces (most notably Farfetch) which may turn out to be competitors but this industry is likely large enough to support a handful of winners with a winner take all business model.

Branding / Authentication

The RealReal authenticates consigned luxury goods. Buyers might not trust buying an expensive purse or watch from eBay or from other websites that do not authenticate its items.

“We have highly trained gemologists, horologists, brand experts and art curators who collectively inspect thousands of items each day.”

The RealReal has invested in its operations to authenticate its luxury products. This might lead to a high barrier to entry for competitors. Not having trained staff on hand to authenticate items might turn away would be buyers from online luxury platforms.

The RealReal focuses a lot on the authentication of its goods and making sure that it stays true to its word of being a pre-owned luxury goods marketplace.

“We build trust in our buyer base by thoroughly inspecting the quality and condition of every item and putting every item through our authentication process. This trust drives repeat purchases from our buyer base and instills confidence in first-time buyers to purchase pre-owned luxury goods.”

“We believe we have the most rigorous authentication process in the marketplace.”

Financials

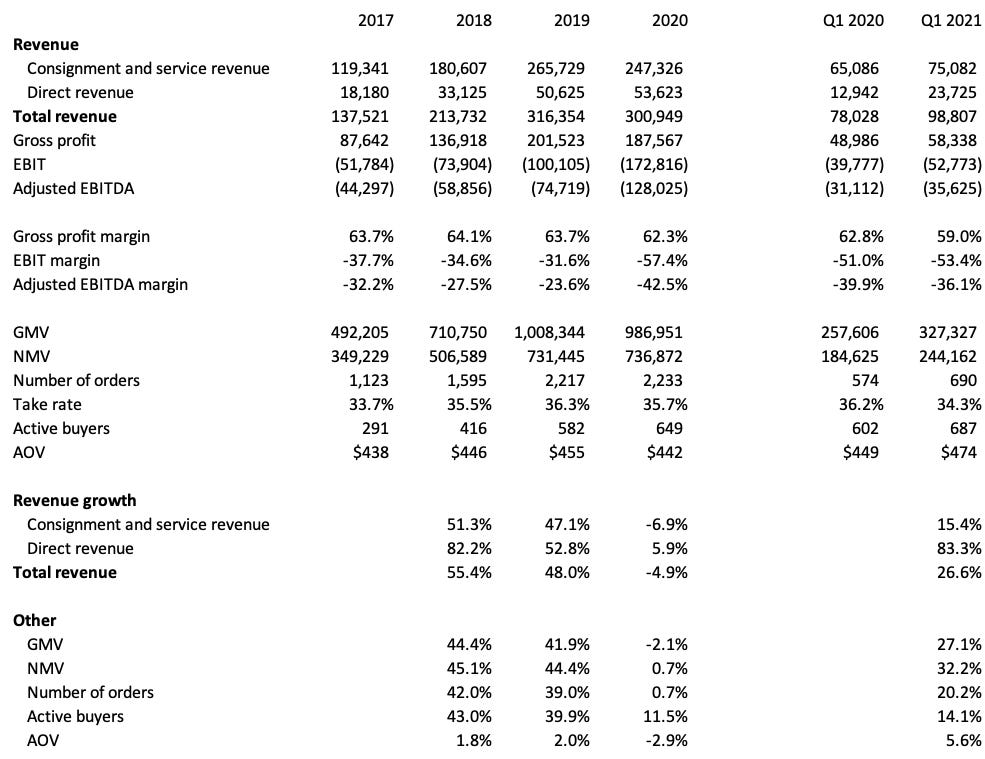

Decided it’s easier to just input a screenshot of the financials instead of just listing it via bullet points. I’ve gotten some questions about putting it into a chart and I think Substack is working on it but don’t know when it’ll come out. For now, enjoy.

One of the impressive things that I wouldn’t have expected is the high growth rates up until 2020. Obviously the business was losing money but it was also trying to win market share and prevent competitors from becoming a huge threat. In a business with network effects, companies will invest in capturing market share until there are no real threats.

Some notes:

NMV = net merchandise volume, which is the value of sales from consigned goods and our inventory net of platform-wide discounts less product returns and order cancellations

Take rate = net consignment sales / (net consignment sales + consignor commissions)

What’s Interesting

High take-rate

The RealReal is able to command a very high take-rate from its consigner. From 2017 through 2020, The RealReal has had an average take rate of ~35.3. I think this high take rate shows how many steps are involved in the process of buying pre-owned luxury goods, to authenticating them, and finally shipping them to buyers. The number and complexity of these steps shows that it has pricing power with its consigners because where else are the consigners going to sell their goods? Consigners can’t authenticate these goods with ease (you likely can but how much would this cost? Is it worth the hassle?).

Strong revenue growth pre-pandemic

The RealReal grew revenue ~52% between 2017 and 2019 and then declined by ~5% in 2020. Maybe The RealReal will continue to grow at high rates again post-pandemic? From before the market drop in February/March of 2020, The RealReal is up ~25% which isn’t too shocking considering it seems like every business is up 50%+ since then.

Future Questions

Buying pre-owned luxury goods?

While one of the sources I posted about shows that the market for pre-owned luxury goods is quite large, I’m not a huge luxury user nor am I the likely demographic for The RealReal.

I wonder if there is such a large difference in demand between buying new luxury goods and pre-owned luxury goods. Do people worry about buying second-hand luxury goods? Do they not care?

Reopening beneficiary?

Does The RealReal benefit from the economy reopening and people spending more money on luxury goods? It seems as though if it does benefit from the reopening, its stock price hasn’t moved accordingly. If The RealReal can return to high rates of revenue growth, the stock price might make a move.

Conclusion

This is an interesting company. I thought it was more along the lines of just a regular online retail marketplace focused on used clothes or something. I like the luxury angle and think having to authenticate items leads to a high barrier to entry for competition. I think there are some risks such as the non-existent revenue growth through COVID meanwhile other luxury companies like Farfetch have been killing it through COVID.

If you’ve enjoyed this edition of Weekly 10-K please considering becoming a paid subscriber, sharing it with friends and colleagues, and following me on Twitter.